File your tax return online or print & mail it

No matter how you transmit your tax return our easy to use do-it-yourself software can help.

You don't need to be an expert to prepare your own tax return

If you're new to preparing your own tax return you may be feeling some anxiety. Fortunately, our online software is built specifically to assist taxpayers and take the guesswork out of preparing returns for the IRS and states.

During the process of completing your return, our software will present a number of interview questions which help you to record your income sources and take all the appropriate deductions. Once all the questions have been answered and the information has been entered, the software will scan for common errors. This step helps to minimize the chance of a mistake which could delay your refund or require an amendment.

If questions arise, usually a quick search of our help database and frequently asked questions can find the answer. If not, we also offer expert online support for free.

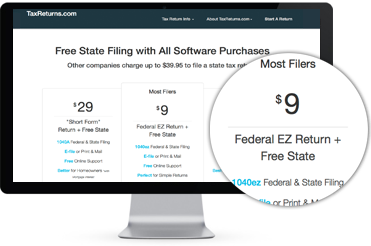

Filing your taxes using our do-it-yourself software is an easy and convenient alternative to paying hundreds of dollars to a tax professional in order to prepare your return. Not only does this allow you to work on your return on your own time, but you and your wallet will also reap the benefits of less expensive tax preparation.

File your return online and see the difference

When you file online you can receive your tax refund in as few as 8 business days with direct deposit (expected refund times vary). Having a busy schedule won't impact being able to complete your return online. You can work on your return from the comfort of your home 24 hours a day.

Calculations are guaranteed, your return is always accurate as long as you've entered the figures properly. You can also rest easy that your return is safe and secure and you will receive a confirmation from the IRS in 48 hours that they are in receipt of it.